Flight testing services provided to Hindustan Aeronautics not taxable as fees for technical services: Bangalore ITAT | A2Z Taxcorp LLP

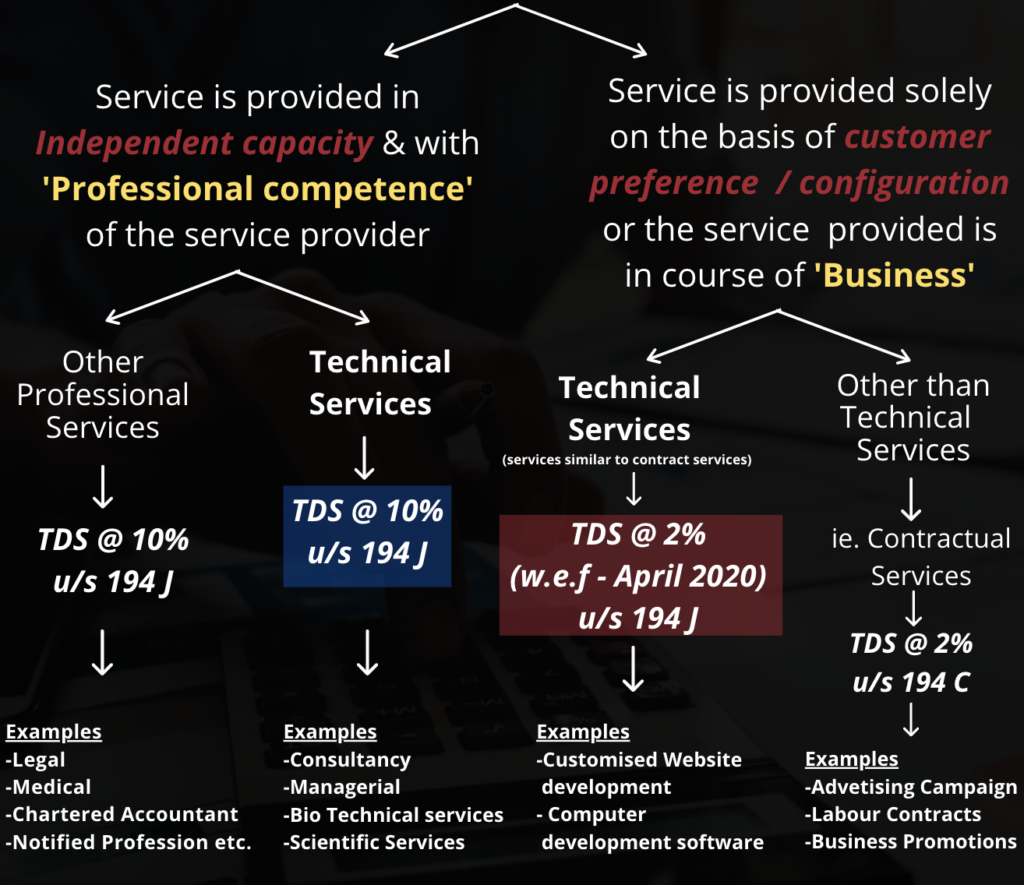

Training Fee Paid To Professional Trainer Doesn't Amounts To Fees for Technical Services, No TDS Deductible: ITAT

Routine business support services are not taxable as fees for Technical Services: Delhi ITAT | A2Z Taxcorp LLP

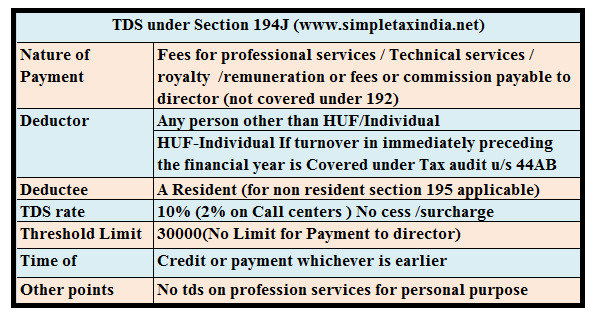

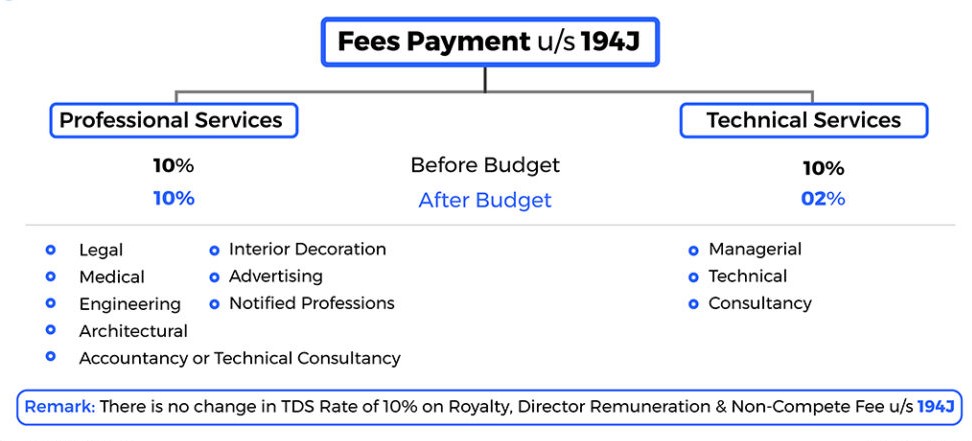

No TDS on account of Royalty/ FTS applicable on Software maintenance fees, consulting and training fees