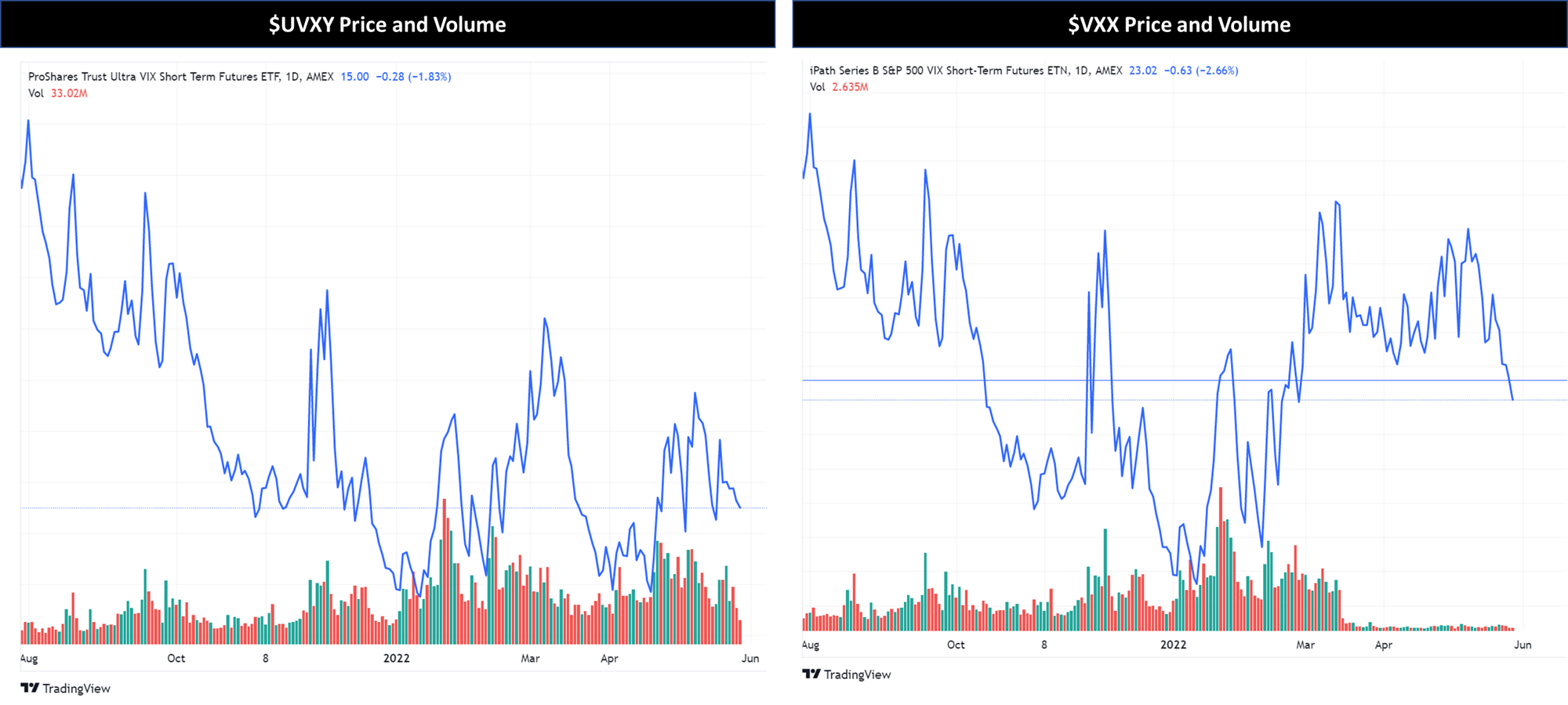

UVXY Institutional Ownership and Shareholders - ProShares Ultra VIX Short Term Futures ETF (BATS) Stock

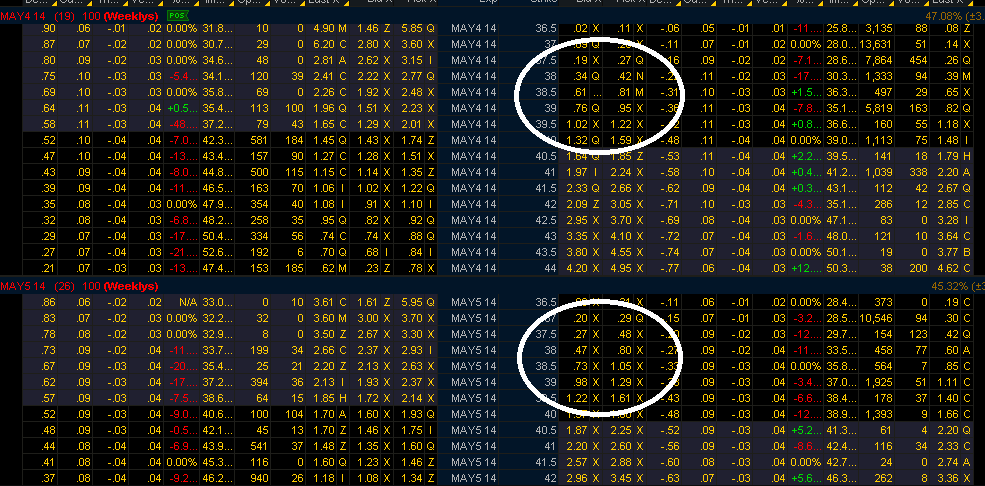

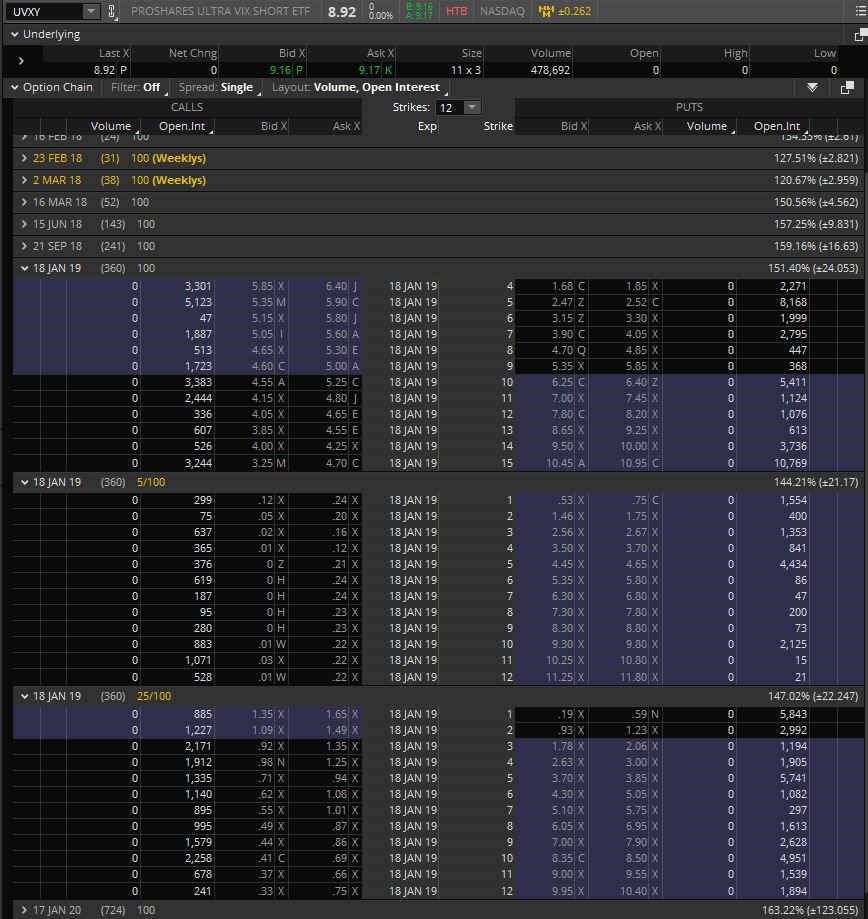

can anybody explain what exactly is happening in BAJAJ AUTO Option Chain today ? When the Stock price is almost Flat, why are the Both CE and PE options are Trading such